Real Estate and the Economy: Turbulent Waters

Mon Dec 10, 2018 by Oppenheim Law on Florida Real Estate & Real Estate Law

The US real estate market is slowing down. Higher interest rates at 4.75% are dragging real estate sales, as first time home buyers and real estate investors alike are not purchasing at a rate that would stimulate an otherwise seemingly solid economy.

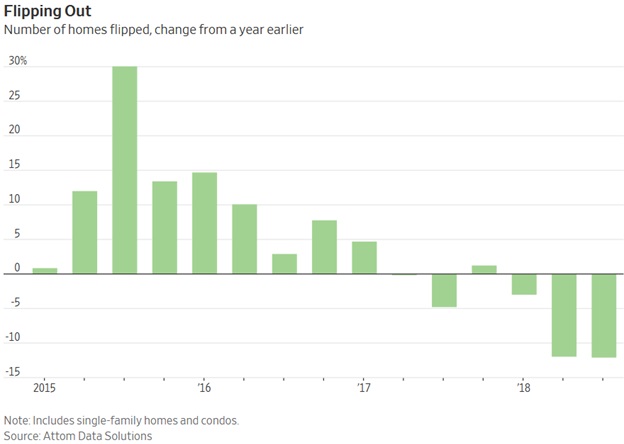

Perhaps most telling is that those real estate investors who “fix-and-flip” real estate are sitting on the sidelines as home-price appreciation has slowed but houses remain expensive enough that it is hard to squeeze out a profit. In fact, according to the Wall Street Journal, the number of new home loans issued with terms of three years or less, typically used by investors looking to make a quick profit, dropped by 11% in the July-to-September period from a year earlier.

“The home flippers are a good barometer of where the market is heading,” said Daren Blomquist, senior vice president at Attom Data Solutions, a real-estate data firm,. “They are involved in such high and quick turnover of properties that they are hyper aware of market conditions.”

So, does the sluggish real-estate speculation market, an indicator of a healthy housing market, predict another financial crisis? Will there be a housing crash? While the current decline does not necessarily suggest a housing crash like in 2008, there is a slowdown in the housing market.

Interestingly, instead of investing in fixing and selling homes, more and more real estate investors are looking to buy and rent long term residential properties.

What does this mean for the residential real estate values? Time will only tell. Hopefully, the Federal Reserve will put the brakes on continuing to raise interest rates. If real estate is a true barometer of the health of our overall economy, then change is in the air.

From the trenches,

Roy Oppenheim

Leave a Reply