Six Signs That We Are Nearing 2008-Like Housing Bubble

Tue Aug 17, 2021 by Oppenheim Law on Real Estate

Forecasters predict that we are on our way to a housing bubble reminiscent of 2008…but for different reasons. While the pandemic created a housing boom, with an increased demand in homes, resulting in shortages and bidding wars.

Yet, this pandemic-era market is markedly different from the late 2000s housing frenzy. Then, the frenzy was due to questionable lending practices and rampant speculation both of which contributed to the 2008 crash.

Unlike the 2008 crash, experts believe that the current market is rooted in the economic law of supply and demand. The shift to remote work increased the demand for homes, and supply was limited due to decades of underbuilding. Low interest rates provided more home buyers, looking to take advantage of record low mortgage interest rates. These factors led to the buying frenzy throughout 2020 and early 2021.

While the housing market may not be in a bubble then for the reasons that 2006 through 2008 was, there are six signs that we are creeping towards a 2008-like bubble for different reasons.

The Six Signs

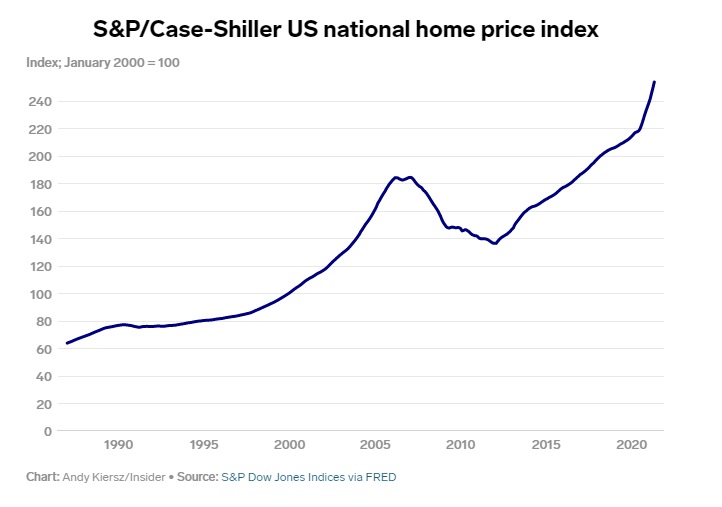

- Home Prices are above bubble levels

The most popular measure of nationwide price growth is the Case-Shiller National Home Price Index which clearly shows that prices are exceeding the late-2000s housing boom. Prices set record highs through this year as incredible demand met with inadequate supply. Bottom line is that prices are above housing-bubble highs.

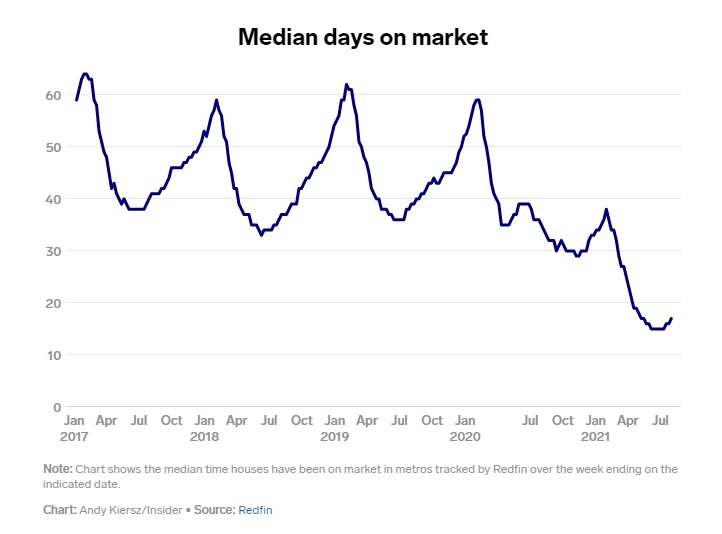

- Home sales have bubblelike intensity

Not only are prices soaring but the rate in which homes are selling is unlike any since 2008. According to Redfin, the median days on the market was only 16 through the four weeks ending August 1, which compares to nearly 36 days at the same time in 2020 and about 38 days in the same period in 2019.

The decreased supply of homes has created bidding wars, resulting in increased home sales with over-asking sale prices. This environment has created a major divide in the housing market, with many who were able to save during the height of the pandemic and yet those unable to afford homes as they either do not have a down payment or their income does not qualify them for a mortgage as housing prices continue to rise.

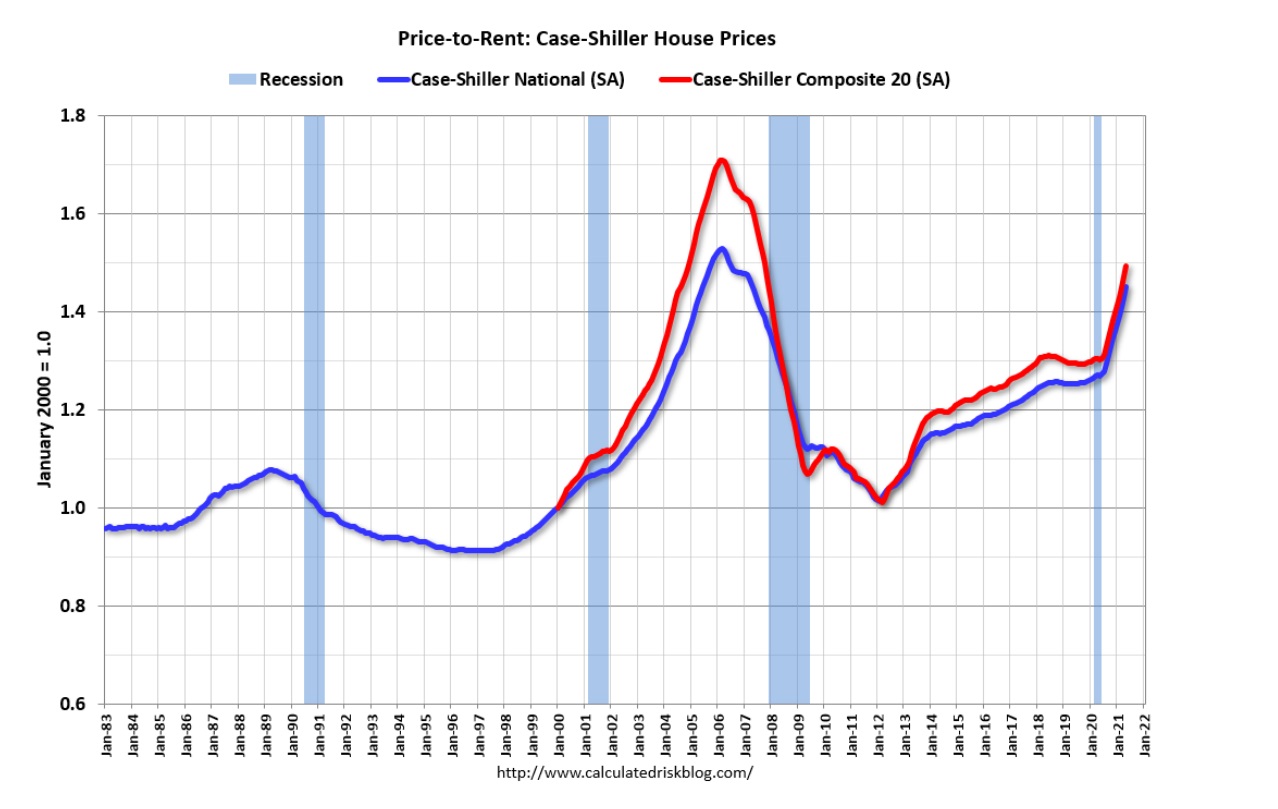

- Rents are Increasing

In addition to home prices, rents have also skyrocketed. The nationwide price to rent ration was just above 1.5 at the peak of the market boom in 2006; and now the same gauge is 1.45 in May and has been on the rise since early 2020. Economics blogger Kevin Drum indicated, “We’re getting close to the 2006 peak…a price to rent ratio this high sure seems … bubbly to me, and I wouldn’t be surprised if the big spike starting in 2020 is COVID related..”

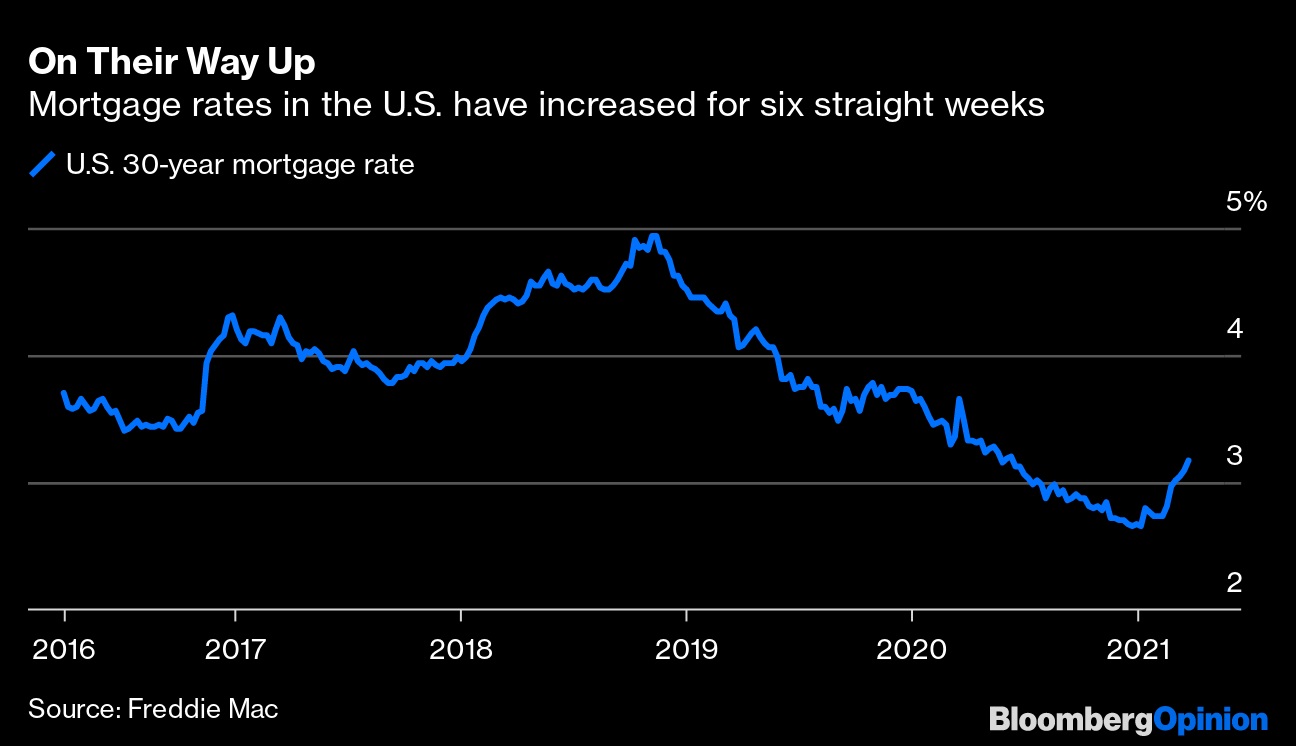

- Mortgage Rates

Mortgage rates will start increasing as the Federal Reserve starts to tighten its belt, thereby making homes more expensive and less affordable.

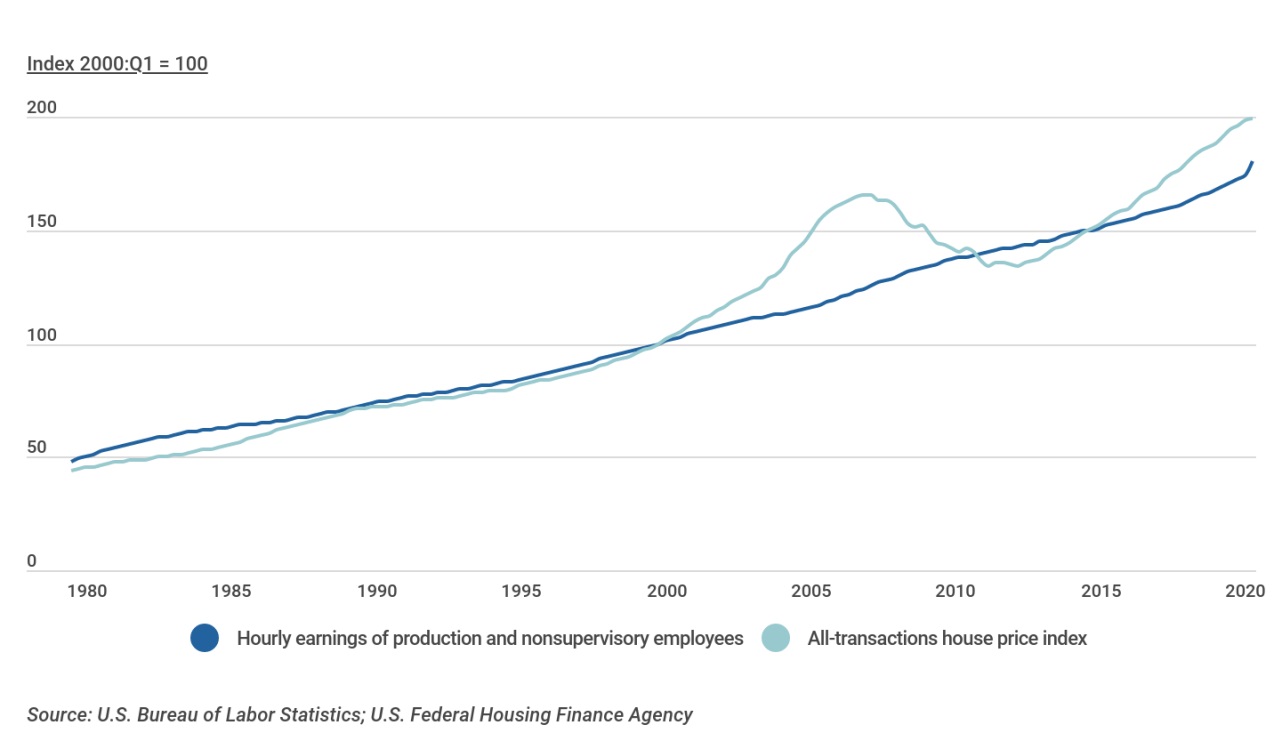

- Incomes Not Keeping Pace with Home Prices

As usual, housing prices have increased in price faster than incomes.

- Exogenous Events

As I had said in the mid-2000s, it will likely be an exogenous event (one that we could not predict) that hastily curtail the last bubble. In that case, it was ironically enough Hurricane Katrina and the video images that somehow deflated the housing bubble. This time who knows what that exogenous event could be? Will it be the COVID variants or the country’s hasty departure from Afghanistan?

What will happen?

While no one has a magic ball to predict accurately into the future, we all may agree that the frenzied housing market is nearing heights that are reminiscent of the mid- 2000s. Whether the impending housing bubble is due to the pandemic or the economic law of supply and demand, or a combination of both, we recognize that the ramifications of the current market, while different, is heading in the same direction.

The pandemic has added a layer of complexity to the mix, and the inevitable likely end of the eviction and foreclosure moratoria adds more challenges to the housing market.

Should you have a real estate legal issue, our team at Oppenheim Law may be reached at 954-384-6114. Should you need assistance with a real estate purchase or sale, our title company, Weston Title & Escrow, Inc. can be reached at 954-384-6168.

Roy Oppenheim

From the Trenches

Leave a Reply