The Tortoise and the Hare: Non-Judicial Foreclosures Equate to Faster, but not Sustainable Recoveries

Sat May 24, 2014 by Oppenheim Law on Florida Law News

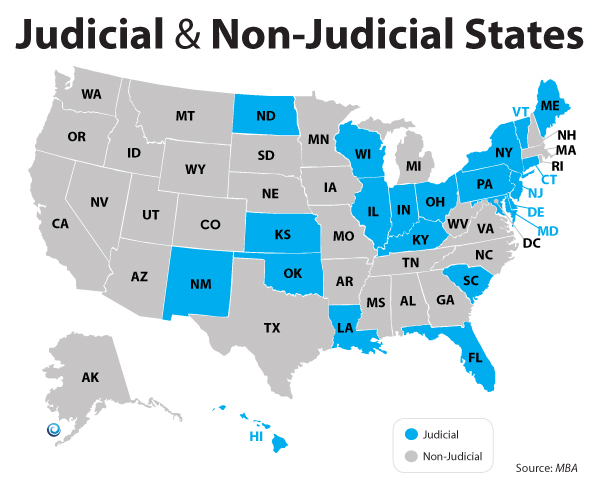

Back in June of 2012 I wrote a column briefly explaining the difference between judicial and non-judicial foreclosure states and I debunked the myth that a housing recovery could only be had if a state was a non-judicial foreclosure state. I explained that the idea of individuals having to give up their property rights is not a necessary ingredient in a housing recovery.

Today, two years later, my theory still holds true. Florida, one of twenty-two non-judicial foreclosure states, continues to experience a robust rebound. Guess what, we did it while maintaining individual property rights and allowing homeowners to be heard by a detached and independent judicial system and making sure that the banks are playing by the rules.

Yes, it is true that non-judicial states are experiencing a faster recovery. In non-judicial foreclosure states, homes with defaulted loans move into new owners’ possession relatively quickly. Homes are less likely to be tied up in court proceedings and deteriorate due to neglection and ultimately drive down prices of surrounding properties. However, the benefits of having an out pacing recovery do not come without their costs.

Keep Tabs on the Integrity of the Banks:

The race back to 2007 peak home prices is not the only statistic that matters. We must make sure that we get to those levels, and surpass them, in a sustainable fashion. What good is it getting to the top and knowing that you are destine to fall? A key element in assuring such stability is to keep tabs on the integrity of the banks. Banks have obligations to their share holders to realize growth quarter after quarter. As we have seen, banks are willing to fulfill these obligations at the detriment of our society as a whole. If it was not for judicial foreclosure states and their ability to test the integrity of banks, robosigning and other fraudulent acts by banks would have never been discovered.

Quicker is Not Always Better:

Allowing banks to proceed unchecked is an invitation for their deployment of another elaborate scheme to capitalize on tax payers for a quick profit. It’s an invitation to allow them to make up the rules as they go with no oversight. The argument that the non-judicial foreclosure process should be favored just because of its ability to generate a quicker recovery is flawed in that it simply ignores the adverse effects that undoubtedly outweigh the benefits of an out pacing market recovery.

Let’s compare two states hit hard by the crisis. California, a non-judicial state, and Florida, a judicial state. As of today, California is about 22% away from the 2007 peak home prices while Florida is about 33% away from its peak. Would you be willing to sacrifice your ability to maintain the integrity of banks–and in turn–the longevity of our recovery for 11% more appreciation? I certainly wouldn’t. Especially given the fact that I am convinced we are going to get there anyway.

The bottom line is that as a nation, we are experiencing a housing recovery. Here are the 5 Stats You Need To Know About The Housing Recovery

Some states are recovering faster, and some slightly slower. Those states that are recovering slower–perhaps because of judicial proceedings–are nonetheless still recovering but are doing so in a more responsible and fundamentally sustainable manner.