Zombie Foreclosures Never Die

Tue Mar 3, 2015 by Oppenheim Law on Florida Law News

If you thought they were gone, think again. The foreclosure phenomenon known as a ‘zombie foreclosure’ has proven that it is here to stay. A zombie foreclosure occurs when homeowners leave their homes when they receive a notice of foreclosure only to find out years later that the bank decided not to foreclose on the property; leaving title in the homeowner’s name.

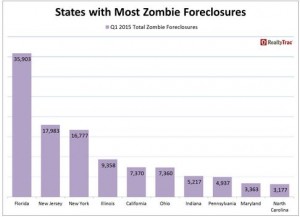

A recent article in the Sarasota Herald-Tribune found that 25% of all the zombie foreclosures within the United States take place in Florida. Even more frightening is that the tri-county area of Miami Dade, Broward, and Palm Beach counties ranked as the area with the second highest number of zombie foreclosures in the United States according to RealtyTrac here. The severity of these statistics, played out against the backdrop of a healing housing market and growing economy is enough to send chills down anyone’s spine.

Those homeowners, who face zombie foreclosure, could potentially have to pay past due fines, property taxes, homeowner association fees, and local government citations. Not to mention the effect these unpaid debts will have on the homeowners credit score, which has already been affected by the foreclosure. This is truly a living nightmare for homeowners who thought they had buried foreclosure behind them, only to see it rise again.

As one of the first firms to realize the emergence of this phenomenon we have been tracking it since 2011.

Video Interview: Roy Oppenheim on Florida Real Estate Double Dip

The American Horror Story winds down in Florida as cases become involuntarily dismissed by judges

Beware of Zombie Foreclosures! Cases Dismissed Months Ago are Now Back from the Dead

Dawn of the Dead (Mortgage): Zombie Foreclosures are Back!

Zombie foreclosures continue: Zombies aren’t after us, they’re in charge of us