20/20 Vision: Impending Economic Recession?

Mon Aug 19, 2019 by Oppenheim Law on Great Recession & Real Estate

The longest economic expansion in modern American history could come to a screeching halt right before the 2020 presidential election. However, unlike our last major economic downturn, this won’t be brought about by the housing market.

Banking On The Past

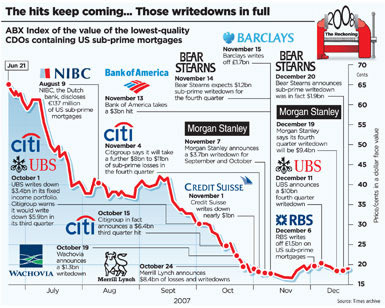

As previously discussed, the 2007 financial crisis was catalyzed by exploitative banking practices which involved deceptive housing market indicators and complete disregard for, admittedly, weak regulatory entities. Nonetheless, as of 2009, there’s been an economic expansion that has become the longest on record, which has seen America’s unemployment rate at a half-century low and subdued inflation as well.

The problem lies with the sustainability of this growth. After all, despite America’s economic expansion lasting well into a decade, it has also been the slowest and smallest when compared to previous periods of economic growth. Even when considering the sugar-like rush brought by the 2018 tax cuts, which skeptics consider mainly benefited the nation’s corporations and its wealthiest citizens while boosting the national debt to a record $22 trillion in the first quarter, signs point to a worrisome end.

What Are The Signs?

Trade policy and geopolitical instability, particularly when it comes to the Sino-American trade and technology war, were considered main factors likely to trigger the next recession. That makes sense given how the conflict is escalating in several ways. For instance, President Trump recently announced plans to impose a 10% tariff on $300 billion of US imports from China effective September 1, 2019 which, unlike the previous round of tariffs, will target consumer goods, such as computers and smartphones. China retaliated by devaluing its currency, the yuan, to an 11-year-low and ceasing its purchase of US agricultural products. Experts worry that China could also lash out by closing its market to US companies like Apple, which would further incite economic panic on a global scale, forcing multinational companies and entities to scramble in an effort to secure their supply chains.

With the current tensions already denting business, consumer, and investor confidence and slowing global growth, the more this retaliation escalates, the more likely another financial crisis would ensure, especially given the scale of private and public debt from both actors.

Housing Implications

Even if the housing market won’t singlehandedly incite America’s next financial fiasco, it certainly will not escape unscathed. Around 51% of housing expert panelists expect that home buying will be lower in 2020. Considering that Fannie Mae, the nation’s largest mortgage financier, is forecasting GDP will slow by almost 1% this year compared to 2018 and that in 2020 GDP growth is predicted to be at its slowest pace since 2009’s contraction, an economic decline could be on its way. All of which hints that our “20/20” vision may not be as optimistic as we had all hoped.

From the Trenches,

Roy Oppenheim

Leave a Reply