A Flip Flop … Flip? Florida Supreme Court Finally Grants Attorney Fees for Homeowners Who Beat Banks

Wed Jan 6, 2021 by Oppenheim Law on Foreclosure Law

Originally posted on dbr DAILY BUSINESS REVIEW by Rachel Lean

A longstanding dispute over whether homeowners should be able to collect attorney fees after defeating a foreclosure lawsuit with a lack of standing defense has finally been resolved at the Florida Supreme Court.

It’s a ruling that opens the door for countless Florida homeowners to recover legal fees from banks and lenders who sued them and failed.

The underlying issue has a rocky history, as the high court originally sided with homeowners in January 2019′s Glass v. Nationstar ruling, then retracted that months later after suddenly finding jurisdiction was “improvidently granted.”

Critics at the time claimed the optics weren’t great, as the retraction came after three justices who signed onto the majority ruling had left the bench.

The latest opinion, issued New Year’s Eve, revolved around Broward homeowner Terri Page, who allegedly defaulted on a mortgage with National City Mortgage Co. in 2009. Deutsche Bank Trust Company Americas filed a foreclosure suit against her as trustee, but lost out when the trial court found it lacked standing at the time of filing and used a deficient default letter.

Page was awarded fees, but the Fourth District Court of Appeal reversed that, relying on its earlier Glass ruling, which found borrowers who win on a lack of standing defense can’t have it both ways by then taking advantage of a fee provision from the same contract.

“NO STANDING = NO ATTORNEY’S FEES,” the Fourth DCA had remarked.

“It’ll be better if the banks would spend a little more time preparing their cases, doing it right the first time, so they don’t have to get schooled by us,” Roy Oppenheim’ said.

But the Second and Fifth DCAs ruled the opposite way in similar foreclosure cases—Madl v. Wells Fargo Bank and Harris v. Bank of New York Mellon—finding homeowners can collect fees if they prevail and have shown they did become subject to the contract’s one-way fee provision.

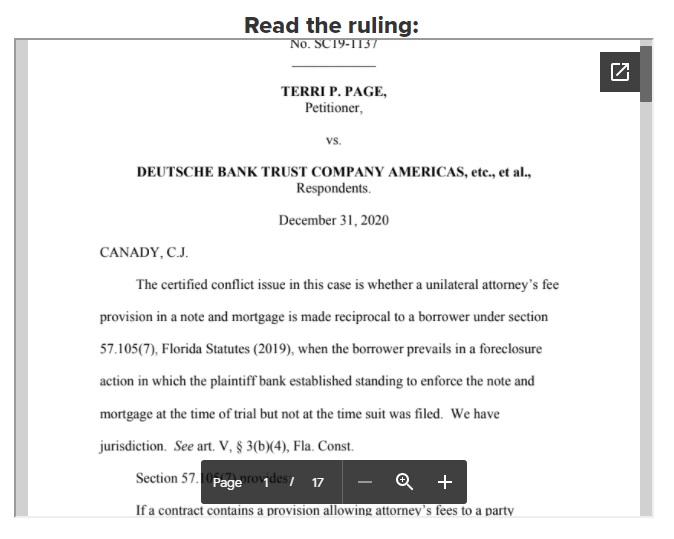

The Florida Supreme Court agreed with the latter reasoning, finding all three homeowners met the necessary conditions under Florida Statute Section 57.105(7).

The statute says: “If a contract contains a provision allowing attorney’s fees to a party when he or she is required to take any action to enforce the contract, the court may also allow reasonable attorney’s fees to the other party when that party prevails in any action, whether as plaintiff or defendant, with respect to the contract.”

The opinion said that plain, unambiguous language provided all it needed to know. It found Page was the prevailing party and explained that just because the bank didn’t provide proof of its right to enforce the contract when it sued, that doesn’t mean there was no contract between the parties.

The Florida Supreme Court said the Fourth DCA had overcomplicated the issue by viewing it as a “rabbit hole” when it actually wasn’t.

And contrary to the Fourth DCA’s finding that ”NO STANDING = NO ATTORNEY’S FEES,” the opinion found those two things aren’t mutually exclusive.

“There was no adjudication that the note and mortgage never existed or that the bank never acquired the right to enforce the note and mortgage,” the opinion said. “The bank simply failed to carry its burden of proving it was the holder of the endorsed note at the time suit was filed.”

What’s more, the panel said that by failing to properly investigate its own claim, the bank brought the kind of suit “that we have recognized results in ‘the wasting of judicial resources and harm to defendants.’”

Nicole R. Moskowitz of Neustein Law Group in Aventura represent Page, and Peter Maskow, William Grimsley and Kimberly Israel of McGlinchey Stafford’s Fort Lauderdale and Jacksonville offices represent the bank. They did not immediately respond to a request for comment.

A Tsunami Coming?

The ruling felt like vindication for Weston attorney Roy Oppenheim, who’s been part of a yearslong fight for homeowners. He has a similar case before the state Supreme Court that was stayed pending the outcome of this one, and should now be able obtain legal fees.

Oppenheim described the ruling as a changing of the tide, and said he’d felt confused by the Fourth DCA’s “indignant” stance on the issue, complete with ”sophomoric” bold font and capital letters.

It’s a matter of fairness, in Oppenheim’s mind, as attorney fees in foreclosure cases can run from $10,000 to $100,000. He argued to rule the other way would mean, “Heads: the bank wins. Tails: the homeowner loses.”

It’s a development that Oppenheim said will prove crucial whenever Florida lifts its mortgage moratorium.

“We expect, particularly in the mid-low to moderate income range, there’s going to be a tsunami of these kinds of foreclosures, and when they occur, mistakes will be made by the bank,” Oppenheim said. “When those mistakes are made, the homeowner will be entitled to fees. So, it’ll be better if the banks would spend a little more time preparing their cases, doing it right the first time, so they don’t have to get schooled by us.”

It was also a win for Peter Ticktin, Kendrick Almaguer and Jamie Alan Sasson of Ticktin Law Group in Deerfield Beach, who supported Page with an amicus brief. Ticktin said the result should give people confidence in the court system, as there is a prevailing ideology among some conservatives that it doesn’t feel right to award fees to homeowners who default on their their mortgage.

“I was a little bit concerned because we have, fundamentally, a new Supreme Court, and I didn’t know whether they were going to be overly conservative or if they were going to basically follow good logical, legal sense,” Ticktin said. “And if this was a test, they certainly passed the test with flying colors.”

Weston attorney Jonathan Kline teamed with Joseph G. Paggi III to support Page’s position, and said this outcome was the only way to level the playing field.

“I take these cases on partial contingency, and sometimes even full contingency, and our clients don’t have money to pay our full fee for the amount of time that we put into the case,” Kline said. “These cases are not simple litigation.”

Homeowners’ attorney Michael Wrubel seconded that, noting that the statute has been the same since 1988.

“It is sad that it took the court 32 years to get this issue right. Often these types of prevailing fee statutes are written for large corporations in order to place their economically, less powerful customers in a disadvantageous position should things go awry,” Wrubel said. “Kudos to this court which unanimously chose to effectuate the Legislature’s intent.”

Chief Florida Supreme Justice Charles Canady wrote the ruling, backed by Justices Ricky Polston, Jorge Labarga, Alan Lawson, Carlos Muniz and John Couriel. Justice Jamie Grosshans didn’t participate.

Leave a Reply