Affordable Housing and the Great Divide

Thu Jun 17, 2021 by Oppenheim Law on Real Estate

The pandemic has created a major divide in the housing market. There are many who were able to save during the height of the pandemic and are now able to purchase real estate. However, at the same time, there are many who are locked out of home ownership because they are unable to afford homes as they either do not have a down payment or their income does not qualify them for a mortgage as housing prices continue to rise.

The State of the Nation’s Housing 2021

Source: Harvard Joint Center for Housing Studies tabulations of US Census Bureau, Household Pulse Surveys, September 2020–March 2021.

Source: Harvard Joint Center for Housing Studies tabulations of US Census Bureau, Household Pulse Surveys, September 2020–March 2021.

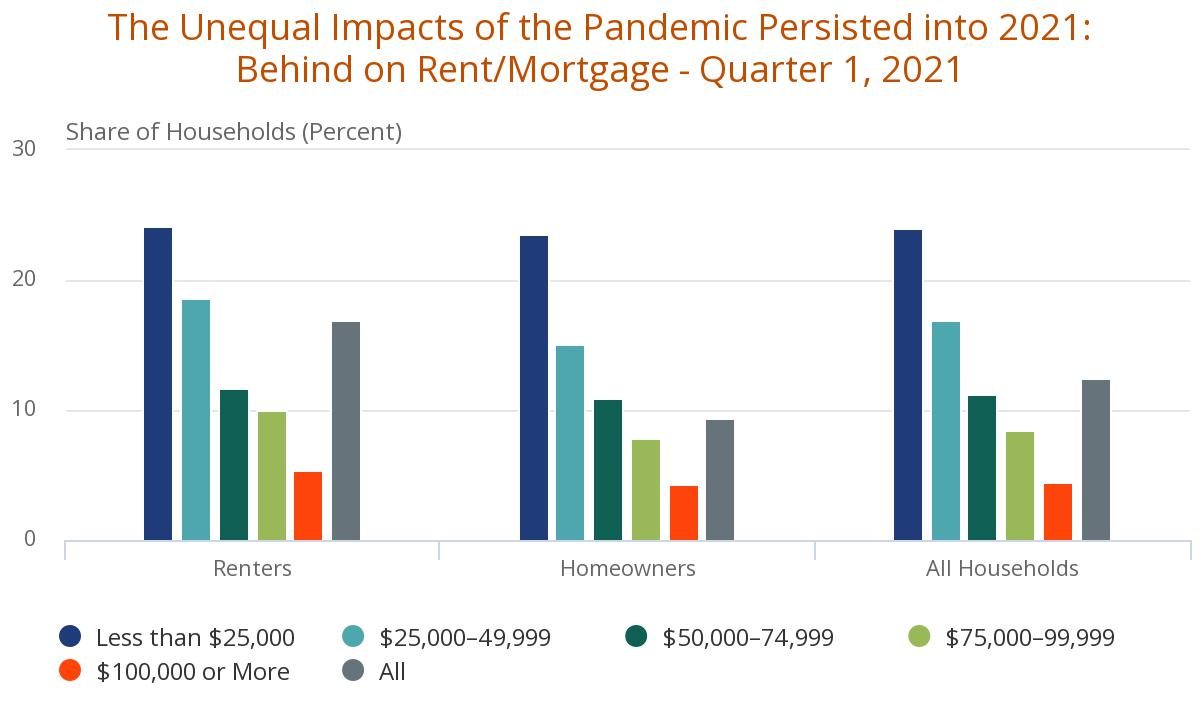

While there are many that were able to save during this time, there are many who struggle to make their current housing payments. The United States averted an economic crisis by providing some $5 trillion in federal relief which included, among other aid, tens of billions in housing assistance and by having federal, state, and local eviction moratoriums. However, a recent Harvard report indicates that the financial damage to low-income households remain severe enough that they will need more support.

The Moratorium’s Effect on Housing

With the economy opening more and more as we are adjusting to a “new normal” in our response to the pandemic, political leaders are trying to determine when to reduce and eventually eliminate the emergency support. Many states and large cities have had substantial eviction protection in place which varied, some of which have expired. The federal eviction moratorium issued by the Centers for Disease Control and Prevention in September 2020 is set to lapse at the end of the month.

What’s Next?

It remains doubtful that the federal eviction moratorium will fully expire soon, as tenant rights groups have lobbied to have an additional one- to- two-month extension in order to process and distribute federal emergency housing aid. By assisting tenants, the aid has assisted landlords in procuring the rental payments. However, the federal moratorium was never a mandate; as a result there have been thousands of tenants evicted during the pandemic despite federal and local freezes for violations not directly related to nonpayment of rent.

Regardless of the moratoriums, the issue still remains that the pandemic highlights the country’s affordable housing crisis due to gentrification, the wealth gap, and a housing shortage for the working class and poor. The question of how much additional government support is necessary to ensure all households benefit from the economy and have access to affordable housing remains.

In the meantime, should you have a legal question concerning one of our practice areas, our team at Oppenheim Law is here for you. Our team at our sister company, Weston Title & Escrow, is here to provide you with assistance with a residential real estate purchase or sale.

Roy Oppenheim

From the Trenches

Needed to post you one very small remark to help thank you very

much again for all the incredible suggestions you have shared on this site.

It’s tremendously generous with you to offer unhampered just what some people might have distributed

for an ebook to get some profit on their own, even more so

seeing that you could possibly have tried it in the event you desired.

The basics likewise worked to be the fantastic way to know that other people

have similar zeal really like mine to know somewhat more on the subject of this condition. I’m sure there are many more

pleasant moments ahead for individuals who view your blog post.