Homeowner Benefit Agreements

Mon Dec 5, 2022 by Oppenheim Law on Florida Real Estate

|

Getting your Trinity Audio player ready...

|

Who Really Benefits?

Homeowner Benefit Agreements are a type of controversial residential listing agreement between the homeowner and a real estate broker. For an upfront fee paid by the real estate broker to the homeowner, these agreements provide that the real estate broker will be the exclusive listing agent for the future sale of the homeowner’s property and shall be entitled to a real estate commission once the property is sold. During the time that the agreement is fully executed and in place, the agreement acts as a lien right for money owed to the real estate broker and contains typically a covenant running with the land that does not expire for several decades. The agreement binds not only the person signing the agreement but any successors in interest who acquire the title subsequent to the agreement’s recording.

Why are these Agreements at issue?

Picture courtesy Fox

There are unsuspecting homebuyers who do not realize that they purchase a home subject to the Homeowner Benefit Agreement, and, as such, receive demands for payment pursuant to the agreement after closing. Should an agreement be recorded on a property, the title commitment should reflect that the agreement is recorded in the property’s chain of title. In order to make sure that the Agreement is terminated, the title company needs to require a written payoff and release from the real estate broker at issue. Without doing so, the property will not have clear title.

Case at Point

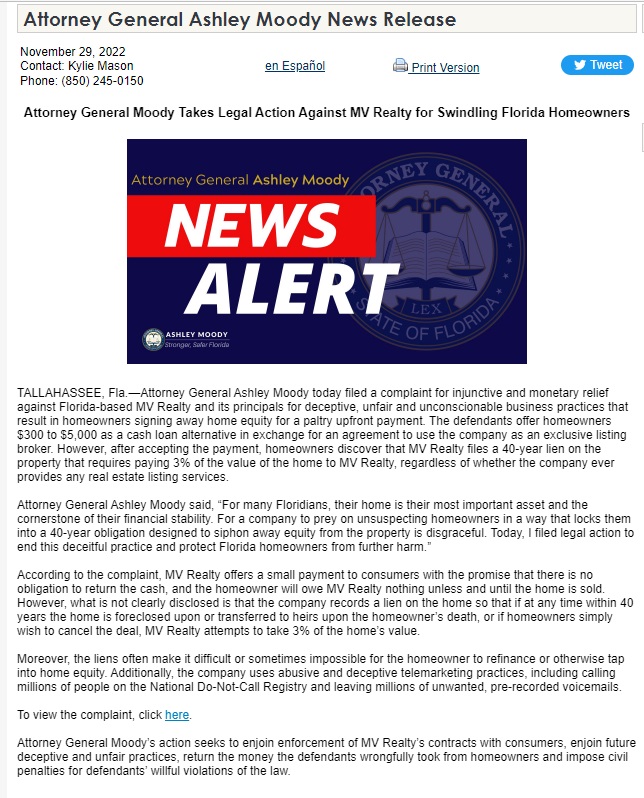

Last week, Florida Attorney General Ashley Moody filed a complaint against Florida based MV Realty and its principals for deceptive unfair and unconscionable business practices that result in the homeowner’s signing away home equity for a small upfront fee. The Complaint alleges the MV Realty offer consumers from $300 to $5,000 as a cash inducement in exchange for the consumers/property owners to enter into a Homeowner Benefit Agreement where MV Realty would act as the exclusive listing broker for a period of 40 years. During that time, if the consumer lists the property for sale but does not use the Defendants as its listing broker, or if the home is foreclosed upon, the heirs wish to sell the home, or the consumers wish to cancel the deal, Defendants seek to be paid 3% of the property’s value—which is to be determined by the Defendants.

By recording these Agreements in the property records, the State contends that the Agreement becomes a lien on the homeowner’s property preventing homeowners from obtaining equity in their homes through refinancing, reverse mortgages, and home equity lines of credit.

The State also alleges that the Defendants further use deceptive and abusive telemarketing and advertising practices to advertise the Home Benefit Agreement by telling consumers that there is no obligation to return the upfront cash unless and until they sell their home when in fact the property is encumbered for 40 years if the consumer does not sell the property. The Complaint further alleges that most of the targeted consumers are seniors and some who have limited cognitive capacity, while others speak English as second language.

Picture courtesy myfloridalegal.com

The State cites to Florida Statute 475.42 (1) (i ) alleging that it is a crime for a real estate broker or associate to place or cause to be placed upon the public records of any county “any contract, assignment, deed, will, mortgage, or other writing which purports to affect the title of or encumber any real property for the purpose of collecting a commission or to coerce the payment of money to the broker or sales associate for any other person for any unlawful purpose.” The Complaint alleges that the Defendants did not obtain the express permission from the consumer to place a lien on their property, and that Defendants’ website does not indicate that a lien is being placed on the consumer’s property. The Complaint further alleges that even if the consumer provided express consent for the broker lien, that this type of “personal contract” is not enforceable as a lien on property.

Amongst additional allegations, the State claims that the payment required under the Agreement is deceptive, unfair, and unconscionable because the Defendants advertise the Agreement as a “loan alternative” with “no obligation to sell” the home and “no need to borrow or make payments.” However, it is alleged that the fact that the consumer will be obligated to pay the 3% of the value of the home to Defendants, should the consumer decide to cancel the agreement, refinance, or attempt to take equity out of the home, was not clearly and conspicuously disclosed. Florida’s Attorney General claims, by filing this suit, that the Homeowner Benefit Agreement in this case was a deceptive scheme to swindle property owners out of their home equity.

What does this all mean?

Issues have arisen as to the transparency of Homeowner Benefit Agreements as to whether property owners truly understand and know that a lien is placed on their property for a lengthy duration (usually more than the actual mortgage time period) in entering such agreements, and whether the restrictions placed on a property which hinder a property owner’s opportunity to take equity out of the property are overreaching and unconscionable. This suit may lead to a revamping of the Homeowner Benefit Agreement to provide more transparency concerning the lien that is placed on the homeowner’s property, shortening the lien duration, or alternatively, potentially obliterate the continuance of a Homeowner Benefit Agreement. It seems the State of Florida is strongly suggesting that the homeowner may not truly be benefitting from these types of agreements.

Stay tuned!

Roy Oppenheim

From The Trenches

I am in a contract I thought it was a 30-year contract apparently it’s 40-year contract I signed on with them after losing my husband a 40 years.. and it was pretty rush rush and I was just saying yes and all the right places cuz my social security wouldn’t come in till for another 6 months and I didn’t even have cat food and they were very kind and we were laughing and telling jokes and then it got down to it they put what do you call the notary online and I said yes and all the right places and I felt really scared and I’m still scared I don’t understand I never even opened the contract when they sent it I’ve lost my daughter in December and now my son it’s a couple weeks ago. My husband and I had five children we raised them in this home and now I just I have to get out I can’t handle it here it needs a lot of repairs and I’m freaking out a little bit now after reading the Shapiro’s news thing out of Pennsylvania I’m sorry I’m crying and I looked at Pam bondi’s here in Florida and I’m not sure which what to do I want to sell it for cash now and I was going to call them I found their business magnet on my fridge and telemarketer called for cash offer and so he was looking it up online so I thought I would and then I found all this and I’m crying now again. I lost my husband and the two of my children. I can’t even get a loan Earth stimulus help because I have no mortgage! I’ve got over 256,000 in equity here.. but terrible credit so I haven’t been able to really do anything except panic. Text me I get so many phone calls just say you’re South Florida law or something I don’t know and please call me or I’ll try calling you I just turned 62. And it wasn’t four or five weeks is that they had got me into this this homeowners benefit program..omg