Moral Hazard v. Mitigation: What will be the response to COVID-19 Foreclosures?

Wed Jul 22, 2020 by Oppenheim Law on Coronavirus, Florida Foreclosures, Florida Real Estate, Foreclosure Defense & Foreclosure Law

As the Coronavirus pandemic unfortunately continues, a substantial number of U.S. homeowners are struggling to pay their mortgages. With nearly half the U.S. population jobless, 4.6 million American homeowners were in some type of non-repayment as of last month which signals that the number of those not being able to pay their mortgage will only increase. As a result, the issue of how the banks are going to react to this upcoming crisis will be key.

Will the Foreclosure Crisis of 2008 return?

We all can agree that the 2008 foreclosure crisis was a mess. There were lenders that engaged in originating questionable loans that resulted in high levels of default. In fact, many lenders viewed mortgages as a “relationship product” which enabled the lender to have their customers gain access to credit cards and deposit services. The mortgages, in essence, were an enticement for bigger business—even when the lender knew that many of the home loans were distressed.

As mortgage loans defaulted exponentially, lenders instituted foreclosures which led to Florida’s notorious “rocket docket,” where retired judges had to be brought in to help combat the enormous volume of foreclosure cases. Ultimately, a $26 billion National Mortgage Settlement was obtained due to foreclosure abuses by the lenders such as lack of verification and proper authentication of the very documents used to support the foreclosure action in the first place.

The key to the basis of the 2008 Foreclosure crisis was the concept of “moral hazard”—lenders belief that going easy on defaults will only encourage other borrowers to default. This concept became a marketing nightmare for banks during the crisis because they were going after their customers who were defaulting in mortgage payments while trying to get the very customers to use other bank services such as credit cards. In fact, there were lenders and mortgage servicers that rebranded and changed their names such as Nationstar Mortgage Holdings Inc. became Mr. Cooper in the aftermath of the 2008 foreclosure crisis.

Mitigation?

Having gone through the 2008 Foreclosure crisis, lenders may consider taking a different approach to dealing with the inevitable upcoming foreclosure crisis. Mitigation is one such approach.

Mitigation is a technical legal term which occurs when there is a breach of contract. One mitigates, or lessens, one’s potential damages due to the breach. In the context of foreclosures, instead of the bank’s “moral hazard” premise, the lenders may wish to come up with a plan to mitigate their damages. Simply put, the lenders may consider how to offset their costs as opposed to flooding the courthouse. One way of doing so may be to have more flexibility in the loan modification process. Or perhaps the government this time will provide assistance for homeowners as opposed to the banks as it had done during the 2008 foreclosure crisis.

Time will only tell how the lenders and the government will respond to the sheer numbers of those who can not meet their monthly mortgage payments when current forbearance plans eventually expire.

For the past thirty years, we have been here to help you navigate these tumultuous times.

From the Trenches

Roy Oppenheim

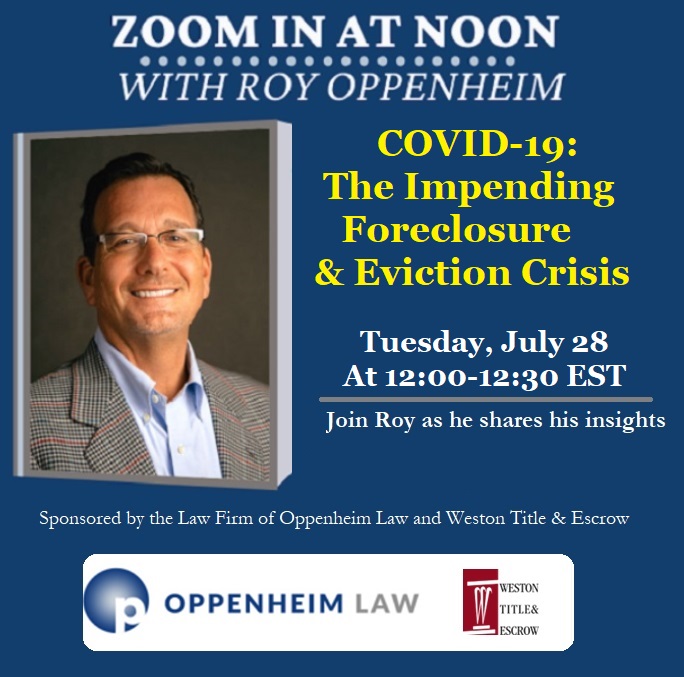

DON’T MISS!

“COVID-19: The Impending Foreclosure and Eviction Crisis”

What will be the response to COVID-19 evictions and foreclosures? Is this the start of the Covid-19 foreclosure and eviction crisis of 2020?

Same Time, Shorter Format 12-12:30pm

Register by Tuesday July 28, 2020 12:00 PM. You’ll receive a confirmation email with a unique link to join the session. Click “Add to calendar” to ensure you don’t miss the webinar.

Leave a Reply