Why Adjustable Rate Mortgages May Be Back In Vogue

Mon Jul 11, 2022 by Oppenheim Law on Real Estate

With economic uncertainty in the market, many homeowners are looking to adjustable rate over fixed rate mortgages. Why? Initially adjustable-rate mortgages, or ARMs, typically offer lower rates than fixed mortgage rates and then adjust at specific intervals over the life of the loan. Currently, ARMs look attractive to those home purchasers who are concerned with both higher mortgage rates, rising as the Federal Reserve increases rates, as well as higher home prices.

What are the advantages to adjustable-rate mortgages?

Picture courtesy Wall Street Journal

According to the Wall Street Journal, as of July 7th, an average rate on a 30-year fixed mortgage was 5.3% whereas the average rates on adjustable mortgages during the same time ranges from 4.25% to 5.46% depending upon the loan terms. For some home buyers, choosing an adjustable mortgage makes sense if rates drop or stabilize by the time the interest note adjusts in several years.

Other reasons to consider ARMs include if you do not plan on staying in your home for more than several years, or if you plan on flipping an investment property. This way, as a home owner, you will enjoy an initial lower interest rate, later selling before the adjustable rate period begins or refinancing to a lower or similar rate mortgage.

Additionally, some homebuyers consider an adjustable mortgage is if they plan to pay off the ARM early, taking advantage, again, of the initial lower interest rates while others choose adjustable rates if they have large loan amounts since the initial monthly savings are larger. In fact, research within the Federal Reserve suggests that many homeowners might have saved tens of thousands of dollars had they held adjustable rate mortgages rather than fixed-rate mortgages.

Why fixed rate mortgages?

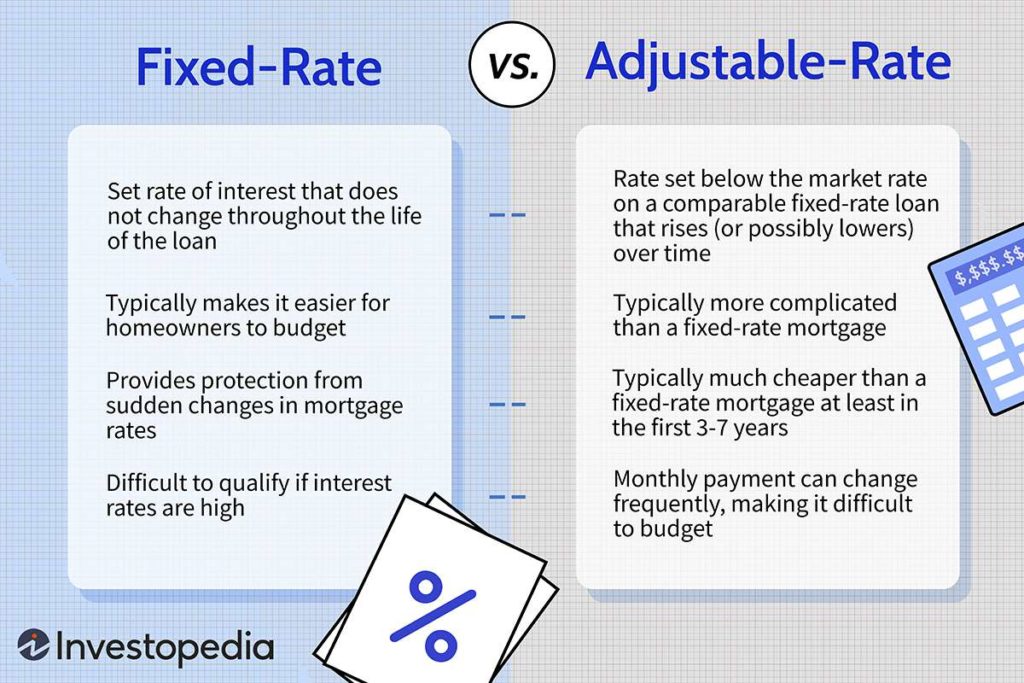

Picture courtesy Investopedia

Many home buyers choose fixed rate mortgages as an attempt to mitigate high debt obligations. By choosing fixed rate mortgages, homeowners are able to lock in their mortgage payment whether interest rates rise or fall.

By choosing a fixed rate mortgage, homeowners do not necessarily realize that they pay a lot of money for the right to refinance, and for insurance against increased mortgage payments. Research indicates that the cost of the benefit to insure against increasing the mortgage payments can range from .05 % to 1.2%, raising homeowner’s annual after-tax mortgage payments by several thousand dollars.

Interestingly, while Americans seem to prefer the certainty of fixed rate mortgages, such mortgages seem unduly expensive to homeowners in other countries because of the higher fees for protection against rising interest rates and for the right to refinance.

What does this all mean?

With the Federal Reserve planning to increase rates again in August, adjustable-rate mortgages may become even more popular for home purchasers as they offer an alternative financial planning tool. As long as the buyer understands the lender terms and is able to sell, refinance, or pay off the terms of the loan before the adjustable-rate kicks in, ARMs are an attractive option. Of course, no one can actually guarantee the future; however, as long as home buyers are able to manage their own interest rates, the market will stabilize.

Stay tuned!

Roy Oppenheim

From The Trenches

Leave a Reply