“A Retrospective From the Trenches of the Great Recession- What remains the same ten years later”

Wed Nov 7, 2018 by Oppenheim Law on Deficiency Judgements, Florida Foreclosures, Florida Real Estate, Florida Short Sales, Foreclosure Defense & Foreclosure Law

Roy Oppenheim’s retrospection on the 10 year Anniversary of the Great Recession. Part two: The unchanged.

I started a series of retrospective posts and videos to reflect upon the tenth-year anniversary of the Great Recession. The first post addressed the consequences of the economic collapse. This post discusses what remains the same after it, and in the next, and last of the series, I will talk about the parties to blame.

Without further ado, the following big issues remain unchanged since the Great-Recession:

- Wall Street “Ethics”.

I finished my last post talking about how according to the International Monetary Fund, as big banks “continue to grow in size and complexity,” the area of values and ethics has not changed. In plain English: Pre-Great Recession’s big unethical banks are now equally unethical, but bigger. Bad combo! One might rationally expect that after the crisis banks would have reevaluated their corporate behavior. Well… NO! After the crisis, all kinds of leaders from different fields, including the Catholic Pope, demanded a “moral economy”, but banks did not to take any responsibility for the economic disaster, instead; they only talked about ethics to point fingers at struggling homeowners that voluntarily entered into foreclosure trying to protect their families from economically-irrational mortgages.

Some years ago, the New York Times published an article called “If War can have Ethics, Wall Street Can, too”. I disagree; it is easier to demand ethics from the chaos of War than the polished offices of Wall Street. I had believed for a long time that banks put their profits before anything else. Banks took, and still take, irresponsible risks without hesitating about the disastrous consequences. They do so for they know that as soon as the proverbial “shit hits the fan”, they only have to cry for the government’s help and they will get it. It is outrageous, but not surprising. If something goes wrong, there is always Uncle Sam to rescue Poor Ole Wall Street!

Any of the members of the “Dirty Dozen” banks list I created years ago can be used as an example of how banks’ ethics remain the same, but just for the fun of it let’s examine one. Let’s take Wells Fargo. The chain of scandals for this particular Bankster started the same way it did for most of the “Dirty Dozen”. Something I named “economic homicide”, or disregarding underwriting guidelines and passing loans as AAA-rated without checking borrowers’ credit worthiness. The purpose was to increase the number of loans, which inflated the real estate bubble, whose burst caused the start of the Great Recession. After that “first” sin Wells Fargo has not changed its bad behavior. It charged users unnecessary fees and insurance premiuns, created unethical sales-incentive programs and we can go on and on. Wells Fargo’s line of scandals has gone so long and so deep that in 2018, ten years after the economic collapse, groups of people were still organizing and protesting against it. The bank’s answer: Of course, a marketing campaign. The new slogan: “Trust”. The lesson: Never underestimate banks’ sense of humor!

- The Wall Street Rule: “he who has the gold rules”.

This Rule was alive and well before the Great Recession, is currently doing great and is showing no symptoms of decay. Wall Street has the money so Wall Street decides what is wrong and what is right and if one bank does something wrong and other banks follow, then the wrongdoing is suddenly ok.

Looking back, it is just incredible that even though since the beginning of the crisis it was evident that the Wall Street Rule had affected the health of the economy, it was not addressed by regulators. But the truth is that Wall Street is still allowed to play with our funds making up rules at its pleasure and has managed to create a system that allocates money beyond the reach of public accountability. Five years ago I wrote in this blog: “I fear there will never be a final Day of Reckoning, and everything will be permanently swept under the rug.” I guess I was right.

- Prices have rebounded; however, salaries have not significantly increased.

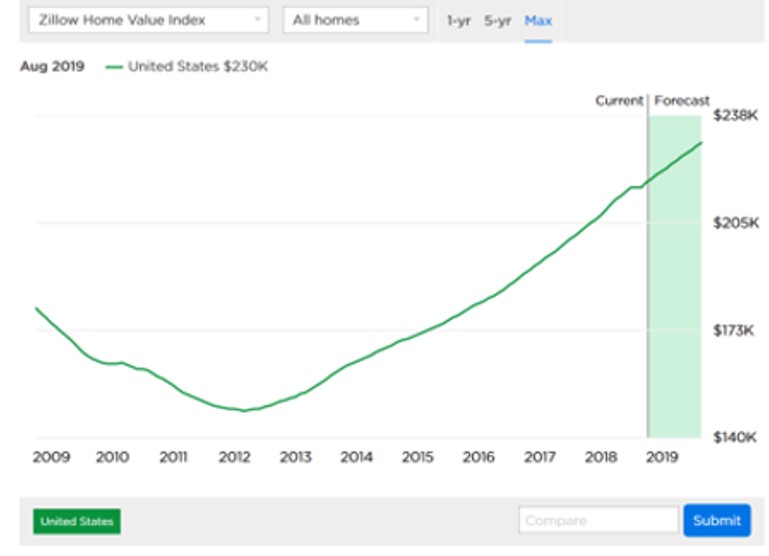

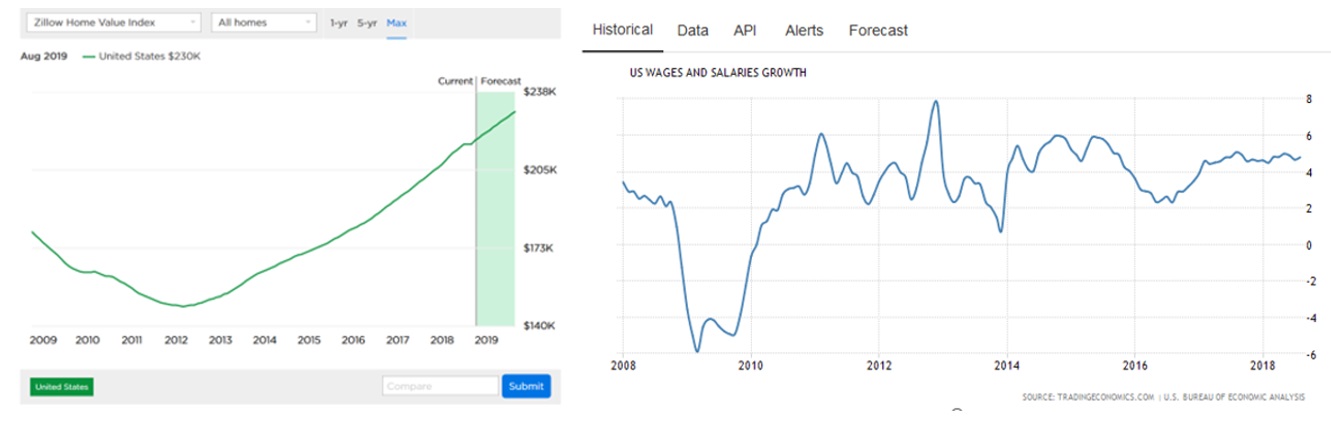

Looking back at the health of the economy just before the collapse of 2008, one of the symptoms that something bad was about to happen, was the inflation on real estate prices. It is normal to see properties gaining value over time, however, when you see significant increases year after year with no logical explanation, you know something is wrong. Affordability becomes an issue, even if real estate prices increase, which in theory should be “good” for sellers. However, salaries did not rise with the housing prices making the purchase of a first home that much less affordable. For example, lower and middle income salaries remain close to what they were twenty years ago. That was the scenario before the collapse of 2008 and currently the market is showing a very similar setting with one difference: now it is so much harder to qualify for a mortgage compared to ten years ago.

Side-to-side comparison of Zillow’s Home Value Index since 2009, including its projection of 2019 prices (on the left), and US wages and salaries growth from 2008 (right).

Side-to-side comparison of Zillow’s Home Value Index since 2009, including its projection of 2019 prices (on the left), and US wages and salaries growth from 2008 (right).

- Foreclosure cases still operate using rules that are not applicable in other areas of law.

There is a judicial systemic bias that allows for the application of made-up rules in foreclosure cases that would never be accepted in other areas of the practice of law. Ten years ago, when foreclosure cases started to increase, it was noticeable that judges presiding over foreclosure courts allowed parties to use and abuse inexistent rules of evidence and procedure. I personally denounced fraud in foreclosure court. I argued that “Judges should be examining the authenticity of the documents produced by the Plaintiff before entering default and granting summary judgment against homeowners.” Many voices raised similar complaints against judge-accepted irregularities in foreclosure courts that would raise eyebrows in other courts. Nonetheless, currently, ten years after, the number of irregularities in foreclosure courts remains almost the same. In some case the taint has moved up the chain, infecting appellate courts as well.

It is true that the courts are more efficient, mostly because the workload of the courts is now manageable (the number of cases filed after 2008 was just unbearable). But the fact is that there is still a disparity on the quality and the strictness of the rules applied to foreclosure cases compared to other areas of law. This is not only unfair, it is impractical, it is easier to decide cases applying uniform laws. If there is another crisis, foreclosure courts will be willfully unprepared to deal with those cases yet again.

For instance, we recently filed an Amicus Curie Brief on a case in which we discussed our view on the issue of whether a borrower in a foreclosure action is entitled to attorneys’ fees, when the borrower has successfully disputed the bank’s standing to bring the action. In our brief we defended the proposition that homeowners should be able to recover attorney’s fees because, among other reasons, removing that right will erode the gatekeeping function of the courts. If the banks do not have to worry about attorney’s fees, they will file suits to foreclose no matter whether they are imbued with legal authority or not because there are no consequences. In other areas of law, Judges will generally uphold measures that prevent wrongful litigation. First, to protect innocent parties from been dragged to court to defend frivolous cases, and secondly, to protect the courts from getting congested with unfounded filings. However, in foreclosure cases this is generally not the case.

- The IRS continues to give an unofficial amnesty to Banks by not collecting funds owed based on REMIC status.

The IRS has audit power, which in theory should be used to protect tax-payers’ money. One of the most important roles of the IRS as a protector of OUR money is to make sure that those entities that enjoy favorable tax treatments comply with the requirements of the Internal Revenue Code (IRC). As early as 2011, the IRS discovered that banks acting as servicers for Real Estate Mortgage Investment Conduits or “REMIC” failed to comply with the requirements of the IRC, however, these entities were afforded massive tax breaks which saved them hundreds of billions of dollars in taxes. When this issue was discovered, the natural public reaction was a sense of relief because the IRS would pursue collection of all such funds and return them to the U.S. Treasury. But that did not happen. It is still a “mystery” why the IRS is not pursuing those claims, but the unofficial amnesty still remains fully intact. Once again; Wall Street Rules!

From the trenches,

Roy Oppenheim

Leave a Reply