CDC Warnings and The Coronavirus: Staying at Home

Thu Feb 27, 2020 by Oppenheim Law on Florida Real Estate & Real Estate

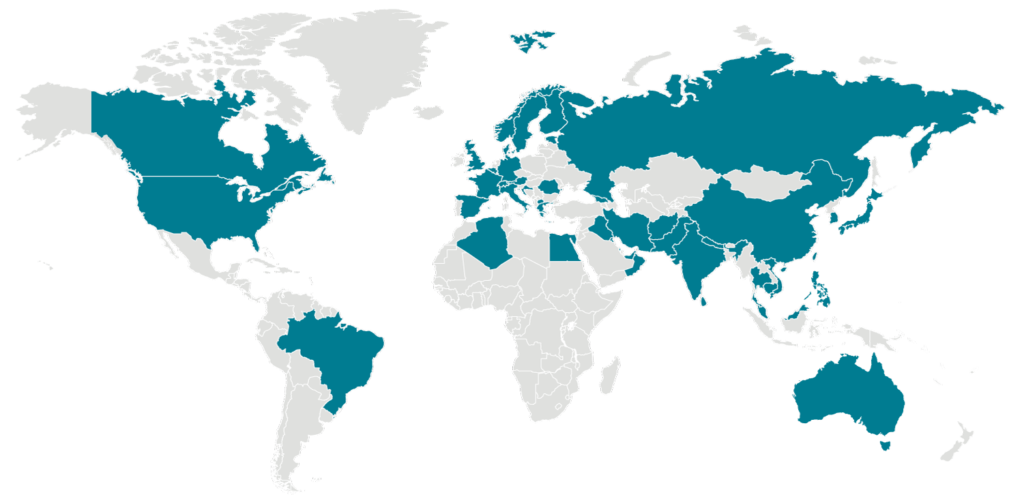

As the U.S. stock and bond markets react to the news that the coronavirus may seriously disrupt the global economy, we have also learned that the United States is not immune to the ravages of the coronavirus that is impacting many parts of the world. In particular, the CDC has recently warned that schools, governments, as well as businesses will need to have plans in place in the event that individuals are required to stay home for as long as 14 days under a potential quarantine, not dissimilar to what is occurring in other countries such as China, Korea, and Italy.

Low Interest Rates: Is this the new normal?

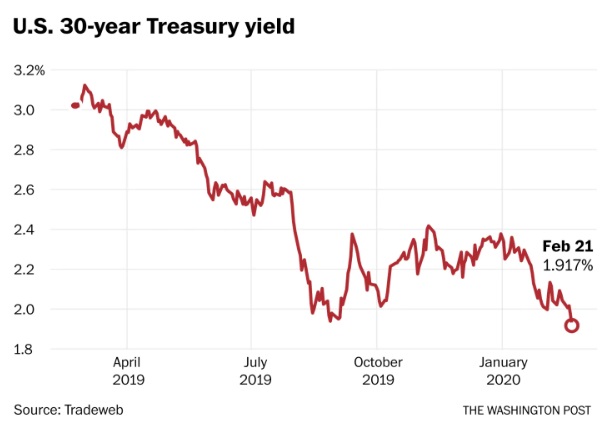

News reports indicate that car makers, airlines, and even Apple I-phones have all been affected by this pandemic. In fact, the interest rate on the benchmark 10-year U.S. Treasury fell to an all-time low this past week, because so many people are placing their funds in treasuries, believing that is the safest place to place their money. Institutions from around the world are also placing their money in the United States for that same reason. As we had stated in our recent blog, when there is such an influx of money in the Treasuries, typically interest rates will drop, as well as mortgage rates.

CDC: Hunker Down and Stay Home

In fact, in other countries, mortgage rates are close to 0 percent, because there is what is typically called negative interest for those people who keep cash in the bank. For example, if you opened a bank account in Switzerland and placed $1,000.00 in the account, it is not unusual to have only $995.00 or $997.00 left in the account a year later. The banks are effectively charging you rent to place your money in a safe account.

Locations with Confirmed COVID-19 Cases Global Map As of 11:00 a.m. ET February 27, 2020

Interest Rates Historic Lows

And while we may not necessarily see negative interest rates in the United States, we will see interest rates that continue to drop to historic lows, which will provide unusual opportunities for individuals and families to refinance existing mortgage loans, pull equity out of their homes, or get rid of high-interest debt such as student loans or credit card debt. Since the CDC and other health organizations guardedly instruct us to be vigilant of traveling and going to public places, we seem to be headed to stay put where we are: at home. The virus may, oddly enough, be a silver lining for those who are considering refinancing their homes, or, in fact, purchase a home.

Protect Yourself

So, the best advice we can give everyone is to wash their hands regularly, stay home from work and school if you are sick, not get too close to people that are coughing, and consider refinancing your home and lowering the interest that you pay to your lenders.

And while we all hope that this virus situation is a terrible once in a lifetime situation and that it will not become more of a new normal to which we will all must adapt, there is an opportunity to hunker down (while watching more Netflix) and take advantage of low interest rates while the virus eventually dissipates.

From the Trenches,

Roy D. Oppenheim

Leave a Reply