Historical Low Mortgage Rates Provide for Personal Elections

Wed Feb 19, 2020 by Oppenheim Law on Florida Real Estate & Real Estate

As the election season starts, the United States is starting to wonder who will be able to lead and help this country the most. But little do they know that this person could be him/herself, and everyone else contributing to the record high multitrillion dollar personal debt.

Breaking Records

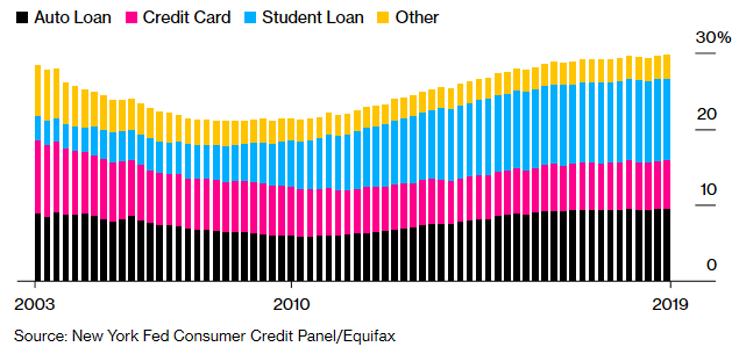

Bloomberg reported, quoting a report from the Fed, that household borrowing increased for the 22nd straight quarter, increasing household debt by 4.4% ($601 billion) to an all-time high of $14 trillion household debt. Mortgages contributed the most, amounting to $9.56 trillion. What perhaps are the more unexpected statistics, and quite frankly more alarming, is that debt for 18 through 29-year old borrowers surpassed its all-time high, now standing at $1.04 trillion, and that more than $100 billion of the total debt is student loans that is held by people over 60.

This level of debt is unprecedented, and when those at most vulnerable ages are being burdened with debt, the economy starts to get uncomfortably close to retreating. Matter of fact, we might be closer to this point that what we think. For example, one in nine borrowers are more than 90 days delinquent or in default on their student loans. And to top it all off, more than half of these student loans are not even being paid since they are either in grace periods or even deferred. However, there may be a simple fix to this issue.

Perfect Timing to Refinance

Very conveniently, this may be the best time to also pay down your loans. Mortgage rates are almost the lowest in history, only 14 basis points away from its 3.31% low in 2012. The current market conditions are perfect for refinancing; with these rates a refinanced mortgage is extremely likely to save borrowers money. As reported by Bloomberg 60% of conventional homeowners have a 0.50% incentive to refinance their loans. Only two months ago only 40% had this incentive. Refinancing your mortgage not only will save you the difference between your current rate and the market’s low rate but it will also help the country’s $14 trillion-dollar debt.

Reducing the monthly amount borrowers are paying for their mortgage will also help people set money aside to pay other higher interest debt, like student loans, credit cards and auto loans. All of which are increasing with no signs of slowing down. Although talking about a financial bubble may be one too many steps ahead, it is not a secret that the current level of debt that households have accrued is obviously not desirable.

So, if while casting your vote you’re wondering if your vote will make a difference, know that refinancing and paying off your loans will not only help your country, but more importantly your very own budget.

Please feel free to call either our firm or Weston Title if we can help you with deciding on whether to refinance or assist you with your closing.

From the trenches,

Roy Oppenheim

Leave a Reply