Climate Change: Rising Seas and the South Florida Housing Market

Thu Oct 15, 2020 by Oppenheim Law on Florida Real Estate & Uncategorized

The notion of climate change, specifically rising seas, affecting coastal homes and properties within Florida is not necessarily novel. We have been addressing this issue for some time, raising the question of how coastal flooding may impact the housing market in general. Yesterday, the New York Times, the Wall Street Journal, and the Sun-Sentinel all reported the same story: Florida Sees Signals of a Climate-Driven Housing Crisis. This topic remains controversial as well as disconcerting.

Demand and Climate Change

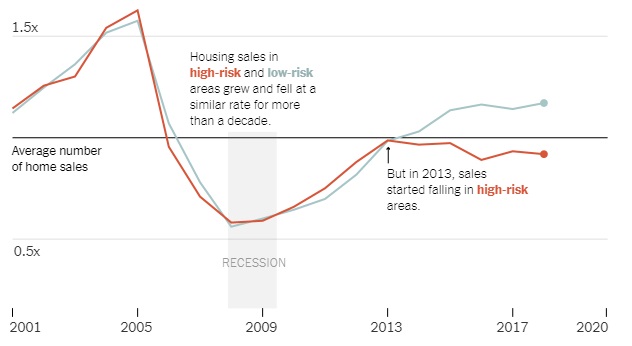

A recent study by Benjamin Keys and Philip Mulder of the University of Pennsylvania, identified a previously unreported decline in sales in low lying coastal areas beginning in 2013, followed years later by a drop in prices compared with “safer” areas while prices and sales on less vulnerable land continued to increase. In 2016, a chief economist for Freddie Mac, warned that rising seas will displace millions of people and destroy billions of dollars in property, and the Union of Concerned Scientists concluded in 2018 that by 2045, 300,000 existing coastal homes will be at risk of flooding regularly.

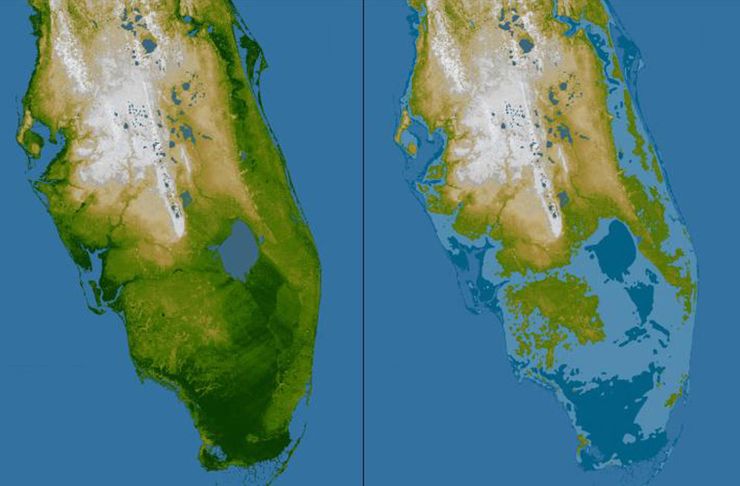

Keys and Mulder focused on whether falling sales could predict a climate induced housing crash. Examining data for 1.4 million home sales over 20 years, they compared developed land that was more than 70% less than 6 feet above sea level with higher areas where less than 10% of the developed land met the same criteria. They found a change in the housing market beginning in 2013, and that by 2018, sales in low lying areas trailed “safer” areas by 16% to 20%.

In Florida, home sales in areas at high risk from sea-level rise have fallen compared to areas at low risk.

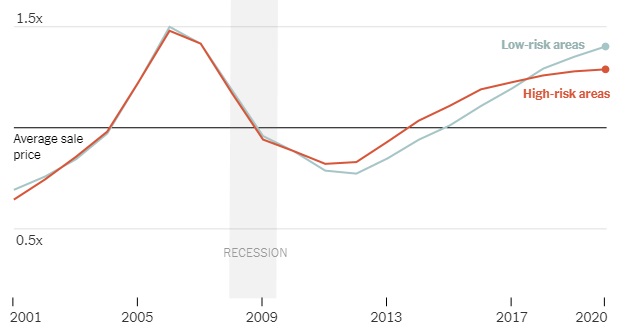

More recently, prices have started to diverge, too.

High-risk areas reflect Census tracts where 70 percent or more of developed land would be inundated if sea levels rose six feet. In low-risk areas, less than 10 percent of developed land would be inundated. Baseline average includes sales and prices between 2001 to 2012.Source: Keys and Mulder, National Bureau of Economic Research

While other factors during the time period may have influenced the research result, such as Hurricane Sandy, Keys and Mulder found that prices in high risk housing markets dropped by 5% since 2018 compared with less vulnerable coastal properties, and that this is part of a trend with prices likely to follow demand downward in low lying areas. This market decline has appeared in Miami-Dade County where prices have fallen by 13% in Key Biscayne and 9% in Sunny Isles. While the market dip may be attributable to other reasons such as families holding their properties, foreign investors having difficulty moving money into the United States, and/or new condos driving down prices, Keys and Mulder found that the housing trend nevertheless held for the rest of Florida.

What does this mean for the South Florida housing market?

The issue of climate change and the housing market is real. The Key and Mulder research indicates that we are in a climate-driven housing crisis—and have been for the past seven years. Whether we are able to fortify our existing land barriers, properties, and shorelines with the assistance of engineering alternatives, is to be determined.

We once again are reminded to be vigilant, and to be cognizant of forces that are not necessarily in our control. Mother Nature is certainly one of them.

From the trenches,

Roy Oppenheim

Leave a Reply